| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Biggest Opportunity in Energy You'll See For DecadesBy

Monday, July 25, 2011

The world's markets for energy are in the midst of a shattering reconfiguration.

For almost the last 100 years, the relatively low price and high quality of crude oil has led it to dominate the market for energy. And since roughly the end of World War II, the world's best and cheapest supplies of crude oil came from the Middle East. The oilfields of Saudi Arabia and a few surrounding areas were astoundingly prolific. They could deliver a potent form of energy for the lowest total cost to almost any market in the world.

The abundance of crude oil, its high energy density, the ease of transport around the world, and the subsequent capital investment in pipelines, refineries, service stations, etc., all contributed to make oil and its byproducts the global energy standard for nearly 100 years.

But that's all about to change.

Last week, the U.S. Energy Information Administration (EIA) raised its estimate for U.S. domestic natural gas production – again. The EIA now says U.S. production in 2011 will equal 65.39 billion cubic feet (bcf) per day in 2011. That's up 5.8% from 2010 production levels. And it represents an all-time high, exceeding the 1973 record of 62.05 bcf a day.

Thanks to new technologies that can produce natural gas and gas liquids from massive shale deposits, growth in new natural gas production will continue for the next several decades. Yes, decades. This has already begun to change the landscape for energy in the U.S. and will reshape the world's power markets, too.

U.S. shale gas is the fastest-growing reserve of energy in the world. And it's the cheapest. There's a tremendous opportunity for investors who understand how shale gas will change the world's energy markets.

To understand why I'm so bullish on certain aspects of the world's natural gas markets, you must realize that hydrocarbons – natural gas, coal, crude oil, etc. – are simply energy. They have various qualities that make them more or less useful and marketable. But at some point, they can be valued by their energy content.

Eventually, entrepreneurs and traders adjust the prices to reflect the differences in the energy content of each source. (In financial circles, trading to equalize markets is called "arbitrage.")

And that's our opportunity. Right now, natural gas is being sold at prices that defy all logic when measured by energy equivalent. In the U.S., natural gas is trading at prices that defy all logic based on market prices anywhere else in the world. My bet is, this situation doesn't last. Billions of dollars will be made as this discrepancy closes.

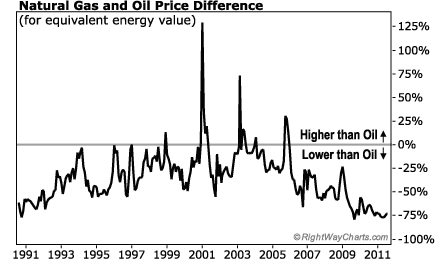

Let me show you what I mean in two ways. First, this chart shows the relative prices of West Texas Intermediate crude oil and U.S. natural gas based on energy equivalence. As you can see, buying energy in the form of natural gas is now 75% cheaper than buying oil. That's a record-breaking difference. That means, wherever possible, energy buyers are going to prefer natural gas.

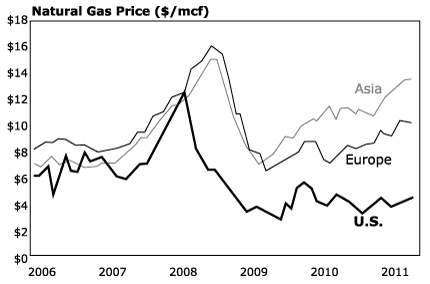

Here's the other key chart. (Our friends at the Motley Fool published this recently.) It shows how since the discovery in America of vast new natural gas reservoirs in 2007, natural gas prices have diverged substantially for the world's major markets – U.S., Europe, and Asia. Today in Asia, natural gas is selling for almost $14 per thousand cubic feet (mcf), while the price in the U.S. is barely more than $4 per mcf.

These two charts imply a huge opportunity. Here's the easiest way to understand it...

Right now, prices for U.S. natural gas are less than half of natural gas prices in the rest of the world. And energy in the form of U.S. natural gas is roughly 75% cheaper than energy in the form of crude oil.

Such a dramatic difference in price in the same commodity – energy – shouldn't exist for long. Traders will always arbitrage the prices back toward equilibrium. I'm going to say that again, just to make sure everyone gets it:

Such dramatic differences in price in the same commodity – energy – shouldn't exist for long. Traders will always arbitrage the prices back toward equilibrium.

One way or another, in five to 10 years, the prices of crude oil and natural gas will not sit so far apart. Wherever and however possible, natural gas will be used in place of more expensive forms of energy, such as coal and crude oil.

The prices will converge... which will make companies involved in the transport of natural gas – and owners of the best natural gas assets – a fortune.

Good investing,

Porter Stansberry

Further Reading:

Porter joins good company in being long-term bullish on natural gas. Matt Badiali and Frank Curzio have recently written about the cheap, hated energy.

"As the value of paper currencies continues to decline, the value of massive, world-class resource deposits will rise... in some cases by hundreds and thousands of percent," Matt says.

"Major trucking fleets are switching their engines to natural gas right now," Frank writes. "Soon, they will be on every major highway across the U.S."

Market NotesNEW HIGHS OF NOTE LAST WEEK

Gold

Halliburton (HAL)... oil services

Baker Hughes (BHI)... oil services

CARBO Ceramics (CRR)... oil services

Helmerich & Payne (HP)... oil services

Oil States International (OIS)... oil services

Key Energy Services (KEG)... oil services

Patterson-UTI Energy (PTEN)... oil services

Royal Gold (RGLD)... gold royalties

Apple (AAPL)... a market "general" heads higher

Intuitive Surgical (ISRG)... robotic surgery

CF Industries (CF)... agricultural fertilizer

Public Storage (PSA)... self-storage REIT

Kimco Realty (KIM)... shopping center REIT

Tanger Factory Outlet (SKT)... outlet mall REIT

Entertainment Properties Trust (EPR)... movie theater REIT

Nordstrom (JWN)... department stores

Polo Ralph Lauren (RL)... clothing

Philip Morris Intl. (PM)... the "basics" way to invest in emerging markets

NEW LOWS OF NOTE LAST WEEK

Southwest Airlines (LUV)... airline

U.S. Airways (LCC)... airline

Delta Airlines (DAL)... airline

AMR Corp (AMR)... airline

United Continental (UAL)... airline

|

In The Daily Crux

Recent Articles

|